Outlook 2026: Clear Thinking, Disciplined Investing, and Perspective

Originally sent to clients on January 12, 2026.

We’re excited to begin 2026 with you. No matter what storms or blue skies we experience together, our role remains consistent: to help remain informed, disciplined, and confident as markets evolve.

Our Commitments

Our work begins with a simple premise—serve clients’ best interests, without exception.

Consulting-only and paid solely by clients. No commissions, no product incentives, no referral compensation.

Pursue investment returns thoughtfully, balancing rewards and risks through disciplined, repeatable processes.

Accessible and responsive when questions or concerns arise.

Wealth management is not just about money. Stress reduction and clarity are central to confidence.

Our Market Perspective for 2026

Rather than making short-term predictions, we focus on durable forces shaping long-term outcomes. Several developments provide a supportive backdrop for markets in 2026. Discipline, patience, and perspective will remain essential as headlines often obscure fundamentals.

Productivity-Driven Growth

The U.S. economy continues to experience meaningful productivity gains. Augmented intelligence adoption is occurring at a pace that already exceeds prior technological shifts. AI copilots boost efficiency in white-collar work like software coding and document drafting, while capital-intensive industries are seeing substantial cost savings—most notably in drug discovery and manufacturing through virtual factory floors and replicated production lines.

AI models can now simulate molecular interactions and screen drug candidates virtually, reducing early-stage discovery timelines from five to seven years to mere months, while cutting research and development costs by hundreds of millions of dollars per successful drug.

Despite this progress, AI’s contribution is still not fully captured in official statistics. Even so, U.S. labor productivity in Q3 2025 rose at a 4.9% annualized pace—the fastest in two years—while unit labor costs declined. Firms are producing more with less labor cost pressure, supporting disinflation even as real GDP remains resilient.

AI Demand and Market Expectations

Additional clarity on AI demand will arrive later in January as major cloud providers—including Amazon, Microsoft, and Google—report results. We believe this information may counter prevailing negative narratives and surprise to the upside.

Federal Reserve Policy

The Federal Reserve may ultimately cut interest rates more than markets currently expect. Hiring has slowed, underemployment has risen, and affordability pressures persist for lower and middle-income households. At the same time, tariff-related price effects have been less severe than feared, and market-based inflation expectations—such as the 5-Year Breakeven Inflation Rate ending 2025 at 2.26%--give the Fed room to ease policy further in 2026.

While Important nuances exist, directionally lower rates would likely support our bond positioning, mortgage affordability, and, via a softer dollar, our international holdings.

Fiscal Policy and Demand

U.S. growth in 2026 should benefit from fiscal stimulus and AI-related capital spending. Estimates of the stimulative effect of the so‑called One Big Beautiful Bill (OBBBA) range from 0.3% to 0.6% of Gross Domestic Product (GDP). Oxford Economics estimates that higher-than-normal tax rebate checks could add another 0.1-0.2% to GDP in the first half of the year. While 100% depreciation of capital goods should support business investment, the timing and magnitude of the impact remain uncertain.

Demographics and Consumption

The economy continues to be shaped by the 76 million Baby Boomers born between 1946 and 1964. Since 2011, when the oldest Boomers turned 65, the number of seniors outside the labor force has increased by roughly 17 million. Continued retirements in the years ahead have important implications for labor supply, savings behavior, and consumer spending—supporting resilience in aggregate demand.

Corporate Profits and Margins

Corporate profits and margins remain near record levels, supported by relatively lower tax and borrowing costs, technology-driven productivity gains, innovative revenue opportunities, and adaptability—particularly notable given recent economic and geopolitical challenges.

Regulatory Environment

After years of expanding oversight and increasingly complex compliance frameworks, financial deregulation has re-entered the policy conversation in Washington. Regulatory compliance represents a substantial cost across sectors such as financial services, healthcare, energy, and transportation. Even modest relief could meaningfully improve margins, investment activity, and innovation.

Portfolio Positioning

With this backdrop, we continue to invest patiently:

Quality Fixed Income

Held primarily for stability, diversification, resilience, and opportunities to offset equity volatility, while harvesting relatively attractive interest payments compared to near-zero yields in FDIC insured cash.

Core Equities

We want to invest alongside tenured managements at businesses that are highly profitable, produce lots of cash, invest back in their own shares, and smartly pursue productivity and revenue enhancements.

Equities Aligned with AI Adoption

We are focused on substance over hype. In an environment where productivity gains and revenue opportunities will not be evenly distributed, quality, execution, and proof of concept matter more than ever. Portfolios include exposure across data center infrastructure, energy supply and storage, and AI deployment.

Selective Sector Exposure

We are increasing investments in sectors positioned to benefit from AI adoption and potential deregulation, including financials, healthcare, energy, and transportation. We expect near-term events such as the J.P. Morgan Healthcare Conference and the U.S. Senate’s legislative agenda on the Digital Asset Market Clarity Act to provide lots of insights and evidence for progress in 2026.

Diversification Beyond Mega-Cap U.S. Stocks

Where suitable, portfolios include allocations to small and mid-sized businesses, select international exposures, and innovation themes such as digital assets, public blockchains, biotechnology, and robotics.

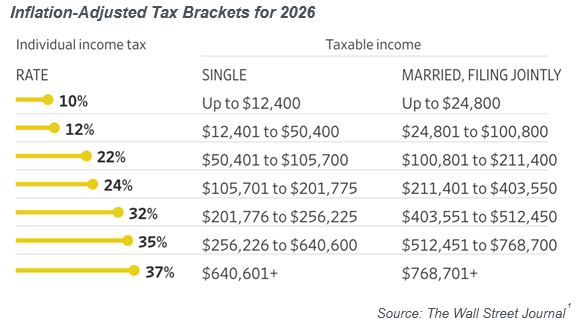

Tax Law and Planning Considerations

Recent legislation has clarified, extended, or indexed several areas of the tax code. For many families, this does not require urgency—but it does reward understanding and coordination.

We discuss tax changes not as triggers to react quickly, but as context for making better long-term decisions around estate planning, gifting, retirement income, and entrepreneurial activity—most effective in coordination with trusted tax and legal advisors.

The below table is sourced from The Wall Street Journal.

Collaboration and Independence

Clients are best served when advisors work together.

Empowered does not provide tax or legal advice. Instead, we collaborate closely with clients’ CPAs and attorneys with the goal for investment decisions to optimally align with estate plans, trust structures, and tax strategies.

Empowered operates as a consultant-only. We are compensated solely by our clients and do not receive commissions, product incentives, or referral compensation of any kind.

This independence allows us to collaborate openly and objectively—while keeping our focus squarely on our clients’ best interests.

Markets will change. Headlines will come and go.

Our approach—grounded in discipline, diversification, and thoughtful planning—remains steadfast.

With over 30 years serving clients through storms and blue skies, we believe portfolio construction should always reflect individual goals, risk tolerances, and tax considerations, with full transparency, lots of communication, and only fair, valued-added costs.

Please reach out anytime to confidentially discuss the details of what we’ve done—or would do--to support you in serving your advisory clients’ best interests.